Rights Issue of Shares Meaning, Example, Procedure & FAQs

Rights Issue Meaning

A rights issue is an invitation to existing shareholders to purchase additional new shares in the company

What is a Rights Issue?

A rights issue is an invitation to the existing shareholders of a company that gives them an opportunity to buy additional shares directly from the company at a discounted price rather than buying them in the secondary market. The number of additional shares that can be bought depends on the existing holdings of the shareowners.

Rights Issue – Overview

Offer of securities by a listed Company to those who are shareholders of the Company as on the record date fixed for the said Rights Issue.

The decision to have a Rights issue -> Taken by the Board of Directors of the Company.

Existing shareholders as on a particular date (Record Date) are offered a right to subscribe to the Rights Issue using their Rights Entitlement

Shareholders also have the right to:

-

- Renounce their Rights Entitlement (in full or part)

- Apply for additional securities over and above what they are entitled to.

Rights Issue – Types of Securities offered

| Fully paid equity shares |

|

| Partly paid equity shares |

|

| Convertible Debt Instruments |

|

| Warrants attached to equity shares and convertible securities |

|

Rights Issue – Date & Key Terms

| Record Date |

|

| Issue Period |

|

| Rights Issue Price |

|

| Rights Entitlement (RE) and Ratio |

|

| Renunciation of Res |

|

| Renunciation Period |

|

| Promoter Subscription |

|

| ASBA |

|

How to Apply in a Rights Issue?

The interested investors can apply for the rights issue online or offline using the ASBA facility or Registrar’s Web-based Application Platform (R-WAP) facility

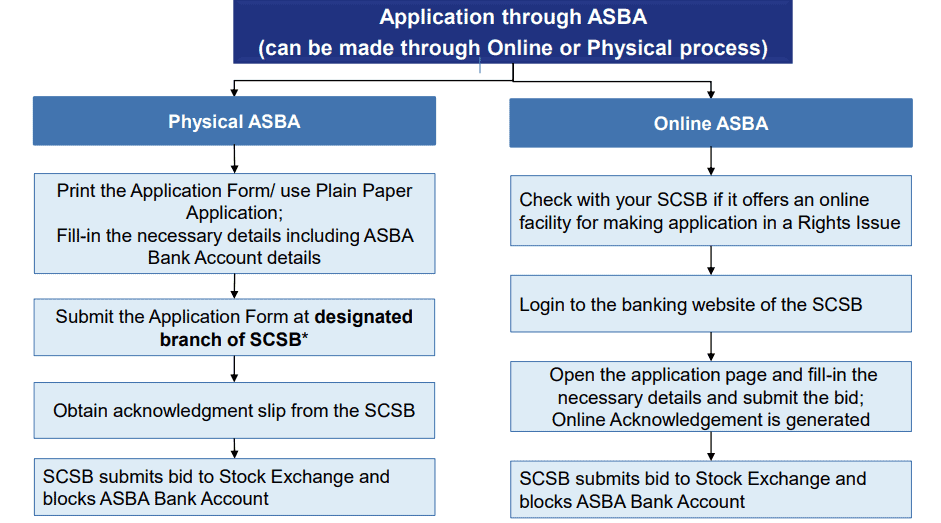

Apply Through ASBA

- Application money remains in Applicant’s bank account till allotment

- List of SCSBs available at:

https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognised

Fpi=yes&intmId=34

Physical ASBA

-

-

- Application Form to be printed, filled-in and submitted to the Designated Branches of the SCSBs

- Applicants can also submit a Plain Paper Application to the Designated Branches of the SCSB

-

Online ASBA

-

-

- Online / electronic application through using the website of the SCSBs (if made available by such SCSB)

- Check with your SCSB if it offers an online facility for making application in a Rights Issue

-

Apply Through Registrar’s Web based Portal (R-WAP)*

- Application money gets debited from Applicant’s bank account

- Please note that the R-WAP procedure may vary; Investors are requested to check the LOF and Application Form of the relevant Rights Issue

-

- Special online application facility created by the Registrar to the Issue

- Applicants to Log into Registrar’s web based portal (details will be available in LOF and Application Form)

- Submit online form using R-WAP and make payment through net banking or UPI (as applicable)

- Online acknowledgment upon successful completion

- May only be available for Resident Investors (check LOF/ Application Form doe further details)

-

Rights Issue – How to apply throught ASBA?

Rights Issue – FAQs?

What is a rights issue?

Issue of Shares to existing shareholders as on record date is called a Rights Issue. The rights are offered in a ratio to the number of shares or convertible securities held by the shareholder as on the record date

Where will I get my application form for the Rights Issue?

Rights Issue application forms are sent to all such registered Shareholders, as on the record date announced by the Company. If a shareholder does not receive the application form, even after the issue open date, he can apply for a duplicate form with the registrar to the issue or apply in a plain paper application format which is available on the Registrar’s website.

NRI’s application will not be posted to their foreign address. They can apply on a plain paper application and have to apply by providing an Indian address

What does ASBA stand for?

ASBA stands for Application Supported by Blocked Amount. ASBA is an application containing an authorization to block the application money in the bank account

Can a POA holder apply on behalf of the Shareholder? What are the prerequisite?

POA should be a registered document with the DP in case of Dem at holding or should be registered with the RTA in case of physical holding. If new, then a notarized copy can be attached with the application form. Banks may not accept the supporting documents and in such cases, investor can send the same to the registrar to the issue, along with the acknowledgment copy of the CAF

Where will I submit my form for the Rights Issue?

Rights Issue forms can be submitted to the participating collection Bankers at their branches, as mentioned in the application form or in cases where there are no collection banker branches, can submit the application form along with the cheque (only non- ASBA cases) at the Registrar’s office.

Applicants can also apply through ASBA process. If your application is through ASBA then applicants need to submit your application to his/her concerned BANK in which applicants holds account

Can I apply for additional shares in the rights issue apart from my entitlement?

Yes, applicants can apply for any number of additional shares but the allotment of the same will depend on shares available for apportionment and will also be in proportion to your holding, irrespective of additional shares applied by applicants

Is ASBA compulsory for me? Can I submit my application through ASBA, even if my amount is less than Rs.2 lakhs?

Only Demat holders can apply through ASBA. If your holding is in physical then applicant cannot apply through ASBA.

For all Resident individuals, ASBA is compulsory if your application amount is over 2 lakhs. As a retail individual, if your application amount is less than Rs.2 lakhs, then applicants have an option to apply through ASBA or through Non-ASBA mode. But, if applicants are a corporate or an Institution then even if the application amount is less than 2 lakhs, the application is through ASBA only.

Whether NRI can apply the Rights Issue?

NRI can apply in the Rights Issue on a plain paper format, available in the offer document but with by providing an Indian Address. If the folio has foreign address, registered then such shareholders (NRI’s) will not be posted any application form nor offer document.

Will the share certificates will be issued to me, if I am holding shares in Physical Mode?

As per the recent directive by the Regulator, Shareholder holding physical shares will have to first convert their shareholding in demat mode and thereafter can participate in the Rights Issue. Please note that if any shareholder holding shares in physical mode submits the CAF without concerting their shareholding in demat, their entitlement (Allotted Rights Shares) will be kept in Escrow Account till they submit their valid demat account details.

Follow us on Telegram for all the latest updates