SIPs Surge in July 2024: Mutual Fund Industry Witnesses Record Inflows

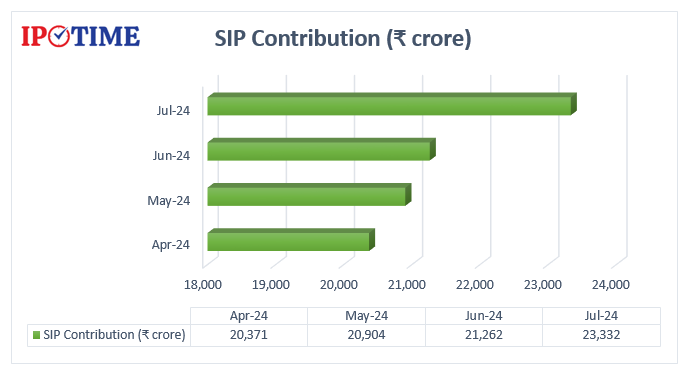

The Indian mutual fund industry continues to ride a wave of investor enthusiasm as Systematic Investment Plans (SIPs) hit a new milestone. According to the latest data released by the Association of Mutual Funds in India (AMFI), the total amount collected through SIPs during July 2024 surged to an unprecedented ₹23,332 crore. This marks a significant 10% increase compared to the previous month’s figure of ₹21,262 crore.

Concurrently, the number of SIP accounts stood at the highest ever at 9,33,96,174 in July 2024 as compared to 8,98,66,962 in June. This reflects the growing popularity of SIPs as a preferred investment avenue among investors.

SIPs: The Power of Consistent Investing

The consistent growth in SIP contributions highlights the increasing financial discipline among investors. By investing a fixed amount regularly, investors can effectively harness the power of compounding and build substantial wealth over the long term. Moreover, SIPs offer a convenient and disciplined approach to investing, allowing investors to participate in the market irrespective of its volatility.

A Strong Foundation for the Future

The mutual fund industry’s robust performance, coupled with the rising popularity of SIPs, is laying a strong foundation for the growth of India’s investor base. As more and more individuals embrace the power of systematic investing, the mutual fund industry is poised to play an increasingly significant role in the country’s financial landscape.