The National Stock Exchange of India Limited (NSE) has announced revisions to the expiry days for select index derivatives contracts, effective from the end of the trading day on January 1, 2025. This change impacts several key indices and aims to streamline trading and settlement processes.

Key Changes in Expiry Days:

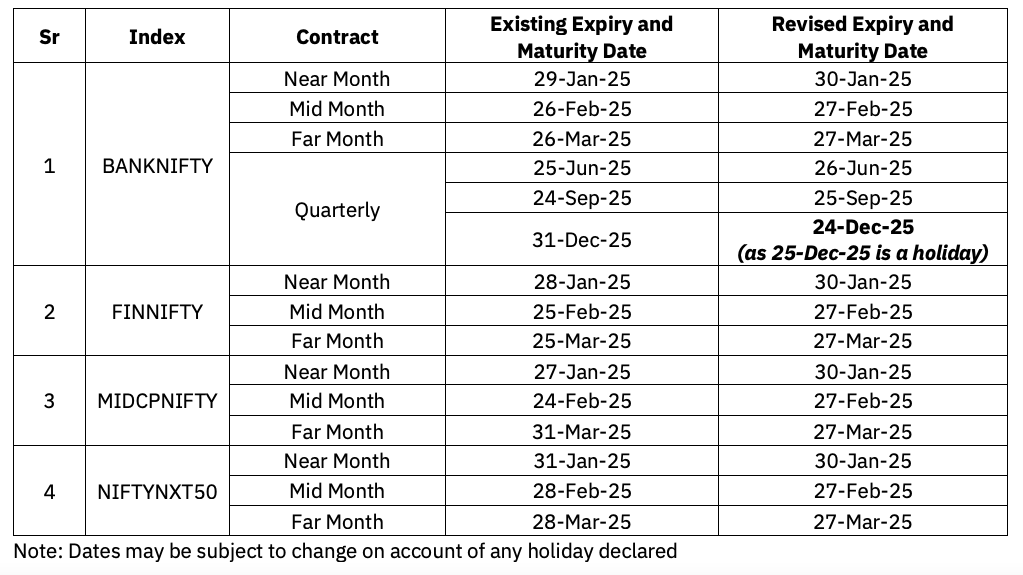

The following revisions have been made to the expiry days of index derivatives:

| Index | Current Expiry Day | Revised Expiry Day |

| BANKNIFTY (Monthly & Quarterly) | Last Wednesday of expiry month | Last Thursday of expiry month |

| FINNIFTY (Monthly) | Last Tuesday of expiry month | Last Thursday of expiry month |

| MIDCPNIFTY (Monthly) | Last Monday of expiry month | Last Thursday of expiry month |

| NIFTYNXT50 (Monthly) | Last Friday of expiry month | Last Thursday of expiry month |

Note: There is no change in expiry days for NIFTY monthly, weekly, quarterly, or half-yearly contracts.

Implementation Timeline:

- Effective Date: The revised expiry days will take effect from the end of January 1, 2025. Contracts available for trading on or after January 2, 2025, will adhere to the new schedule.

- Updated Contract Details: The updated expiry dates for all existing index derivatives contracts will be reflected in the contract files generated on January 1, 2025. These updates will be applicable for trading starting January 2, 2025.

Operational Adjustments:

- Settlement Schedule: The Clearing Corporations will provide a separate update regarding the settlement schedule.

- Contract Files Update: Members are advised to download the updated contract files, including

contract.gz,spd_contract.gz,MII-Contract.gz, andMII-spd contract.gz, from the extranet path before trading resumes on January 2, 2025.

Key Notes:

- This revision affects only the expiry day and does not involve any other changes to the contract specifications of index derivatives.

- To ensure smooth operational transitions, members are encouraged to review the provided illustrations and updated contract details shared by NSE.